Contoh Payroll Gaji Excel

Pay day is one of the most important days in an employee’s life. This is because it gives the employees a sense of satisfaction that the blood, sweat, and tears that they have given up for the sake of their work has finally paid off—literally! As an employer, it is your duty to ensure that your employees’ salary gets to them on time. Getting their salaries on time boosts their morale which ends up improving their motivation to do their job. It is also highly important that pay and taxes are calculated in an accurate manner. No matter how minimal errors in calculation may be, you do not want to upset employees. There are but there are also a couple of benefits to doing payroll on your own.

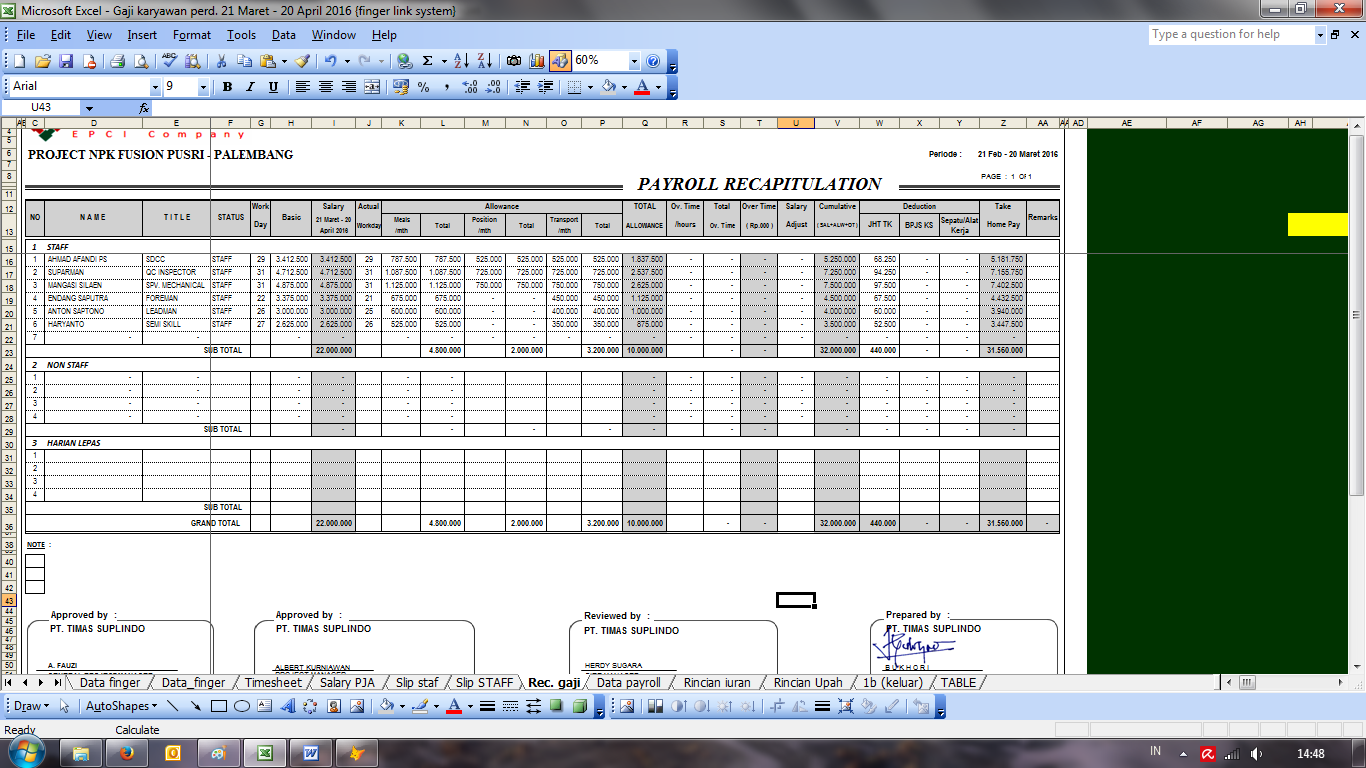

One of these benefits is the fact that you can save a couple of dollars by calculating and processing your own payroll. If you think you have ample amount of knowledge regarding calculating payroll, you can definitely make use of Excel or any other similar applications that can help you come up with your very own payroll spreadsheets and worksheets, and be able to calculate your company payroll in an organized manner without the need to shell out money for software and outsourced accountants.With that being said, we would like to give you a couple of guidelines to help you come up with your very own payroll spreadsheet. We have also uploaded a couple of that can make the creation of your company payroll worksheet easier than ever. Now the big question: Are you ready to explore and learn more about payroll?

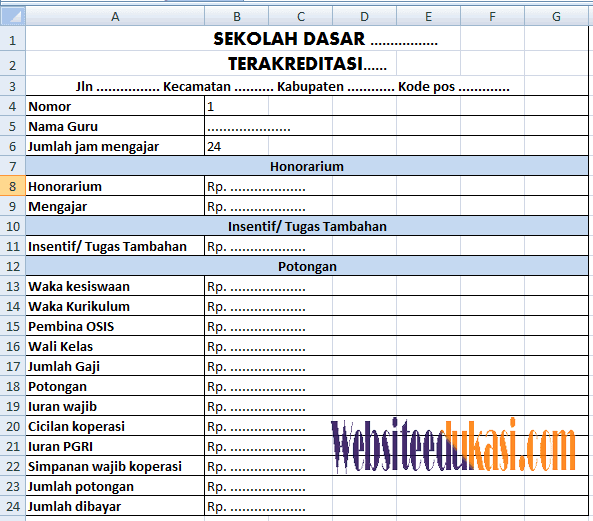

We promise to share more information with you if you also promise to continue reading this article. Let’s do this! Sample Payroll Timesheet Template. File Format. XLSSize: 6 KBWhat Are the Elements of a Payroll Spreadsheet?The elements of a payroll are not that complicated. In fact, there are only a couple of things that are included in it. The basics are the names of your employees, the hourly wage, the deductions such as taxes, and other specific data that is specific to the employee.

The gross pay of an employee is also reflected in the payroll as well as their net pay or take home pay.What are the common terms that you will find in a payroll?. Payroll – Payroll refers to the process of calculating the pay that you owe an employee for a specific period of time. Taxes – There are a lot of taxes that is deducted from an employee’s pay. This can include income tax, state tax and federal taxes. File Format.

XLSXSize: 13 KBProcessing Payroll Taxes and Employee PayrollProcessing payroll taxes can be quite a chore. You have to first figure out how much you will need to pay your new hire. After that, you will have to check out a tax table in order to cumpute the taxes that you would need to deduct from the gross pay.In order to do this, we would like to give you a step-by-step guide on. Landwirtschafts simulator 2019 ps4 cheats. You may still want to consult a payroll expert if you want to make sure that you are doing everything right. Doing Payroll TaxesFederal taxes, state taxes, and local taxes all fall under taxes that can be deducted from an employee’s pay.

It also includes Social Security fees, medical insurance, and income taxes. Knowing the current tax rates is also important if you want to make sure that you are able to properly and accurately compute for the taxes of your employees. You can take a look at payroll tax basics by reading up on. Processing the PayrollProcessing payroll on your own can be a bit time-consuming and you may also find that errors are quote inevitable when it comes to doing payroll on your own. However, if you have taxes covered and you feel like you have a good grasp of processing taxes, you will surely find that the DIY payroll processing may be the one for you. Just make sure that you are confident enough to do it on your own before you start to dive in to the adventure of doing the payroll on your own.To get you started, here’s what you need to do:.

Make sure that your employees fill out a W-4 form. All employees need to complete a W-4 form. This form will be best for ensuring that the you have prepared will be filled out with the correct or accurate information that you would need to ensure that computing payroll would be a breeze and will not take too long. The W-4 form will also help you determine the allowances your employees are entitled to and deductions that you would need to take from the pay. Sign up or register for an EIN. An EIN or Employer Identification Number is a unique number assigned to every business. It is kind of like the SSN of your business but slightly different. An EIN is used by the IRS to distinguish you from the other businesses. Set up a payroll schedule. When coming up with a schedule for payroll, you have to make sure that you also consider employee tax date deadlines, tax due dates, and tax filing deadlines.

How To Make Payslip In Excel

Choose a date that would be convenient and will not need you to go procrastinate to finish one payroll task and another. Calculate taxes and withhold the taxes. Determine the amount of taxes that you would need to deduct from your employees’ pay.

You can refer to tax calculators in order to accurately determine the amount you would need to deduct. Keeping track of the portions that you need to contribute for taxes and the employee portion of taxes is vital. You can take a look at our to help you out with payroll tax calculations. Pay the taxes. When tax deadlines come up, make sure that you are able to pay it in a timely manner. This is usually done on a monthly basis.

File tax forms and employee W-2 forms. W-2 are forms that you issue to your employees at the end of the year. This way, they would have an awareness as to how much their annual filings are. Be sure that you are prompt with the filings.You can gain more information about taxes and other payroll tips by checking out our article entitled. Why Make Use of a Spreadsheet?You can make use of whatever application is available on your computer such as text editor applications, but making use of spreadsheet applications will be more convenient because of the capacity of spreadsheets to accurately calculate and tally up totals.

You can also edit texts in spreadsheets just the same way in a text editor.You can also easily input formulas and calculations in a spreadsheets that would make quick calculations that would make it easier for you to know how much you owe your employees. You may think that payroll will just involve addition and subtraction but it does involve a whole lot more than that. Considering Excel Payroll SpreadsheetsSometimes, things work out in ways that you do not imagine it to.

Sometimes, you think you need to outsource an accountant in order to come up with an organized company payroll. But sometimes, rethinking what your company actually needs can be a huge step that can help you save on money. This is when Excel payroll spreadsheets come in handy. You have to consider that there are a couple of risks involved when it comes to doing your very own payroll, but you have to be always ready. While a payroll software can take care of all of these things with just a couple of clicks, being hands on with the accounting of employee salary can help you answer some questions regarding any discrepancies in a better manner as you know the whole process. Payroll is important and can even help you understand the regulations and taxes even more.Worried that you might not make it to the deadline of your pay period? You may want to check out.

Pay is important, which is why you should take responsibility even if you are going to be late with it.